Originally posted on April 5, 2022 @ 1:39 pm

Litecoin (LTC) is an digital currency that is peer-to-peer and was created at the end of 2011 in 2011 by Charlie Lee (a former Google employee). It is based upon bitcoin’s code base and shares many of its characteristics. The Litecoin cryptocurrency can make everyday transactions more efficient and making transactions more affordable. Bitcoin however can be used for long-term storage. When compared to bitcoin the market cap for the current limit is higher for the cryptocurrency litecoin, making the mining process faster. This means it is that, even with their lesser size, transactions can be completed faster and more affordable.

What is the word “Litecoin?

Litecoin is an online form of currency, like bitcoin. Due to Blockchain technology, this cryptocurrency can facilitate direct payments between businesses or between individuals. It makes sure that the public record of transactions is kept. It permits the currency to function as a decentralized system of payment that isn’t subject to government oversight or censorship.

Like many other kinds of cryptocurrency could be considered to be a peer-to-peer cryptocurrency that is decentralized. It comes from a fork of Bitcoin blockchain that is which is a digital record that is used by the majority of cryptocurrency. Litecoin permits almost instantaneousand low-cost transactions between individuals or companies across the world.

Litecoin as with Bitcoin utilizes a proof of-work method (PoW) to verify transactions made through the Blockchain. However, it’s classified as an “lighter,” speedier version of Bitcoin because of significant improvements. The major distinction among Litecoin as opposed to Bitcoin is the fact that Litecoin utilizes the script method of mining that allows for quicker transactions.

Litecoin Cost Today

| # | Name | Price | Changes 24h a day | Market Cap | Volume | Supply |

|---|---|---|---|---|---|---|

| 1 | (LTC) LITECOIN |

$126.17

|

^0.22% |

$8,828,623,061.00

|

$689,057,003.00

|

70,000,933.23 LTC

|

Litecoin is a four-fold boost in supply. Litecoin produces each 2.5 minutes, nearly four times more than Bitcoin’s 10 minutes. The amount of Litecoin can be restricted up to 85 million dollars. Bitcoin however, in contrast is able to hold up to 21 million coins.

In contrast to typical fiat currencies such as the euro or dollar, the amount of litcoins can be limited to around 84 million units. The number of Litecoins that can be retrieved is estimated at 67 million by the end of October 2021.

Mining Litecoin is like mining Bitcoin and other coins based on blockchain. Miners utilize powerful computers to validate each transaction block and then add this to Blockchain which requires millions of calculations. In the end, the phrase “evidence that is reliable” was created.

The majority of blockchain-based transactions are expected to be confidential (although they are, in essence, they’re pseudonymous because each user has their own unique address). Once the previous block is validated the block that follows, it adds an additional chain. Miners who are successful in confirming the league be awarded 12.5 Litecoins. The number of Litecoins given out is reduced by half every week, much like bitcoin.

Price of Litecoin

The supply total of Litecoin limits to an 84 million coin supply. The project started with 150 tokens which had already been mined. The project established the block reward at 50 litecoins for each block upon its inception, with the block reward being split every 840,000 blocks thereafter. In 2142 the last block-based project has mined.

A long period of sideways movement are a common feature throughout LTC price time. The price of Litecoin broke above 250 in the month of December and in April/May 2021, achieving a peak of around $410 each occasion before falling. The price of LTC hit an all-time high at $412.96 at the end of May in 2021 however, it fell by over 50% over the next six months.

Inputing the public-key details that is associated with every person’s electronic wallet Litecoin customers can send or receive LTC through the Blockchain.

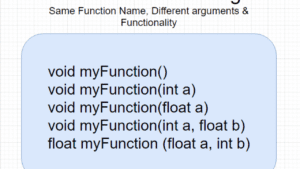

As we’ve mentioned before the code of Litecoin is identical to Bitcoin’s. It is not like Bitcoin’s proof-ofwork consensus that pits users who are referred to as “miners” against each other using advanced computer equipment in order to become the first discover new blocks. LTC employs the Scrypt proof-of-work algorithm that allows its users to create blocks using consumer grade technology.

Another characteristic that differentiates Litecoin in comparison to Bitcoin is the amount of time required to verify blocks. Blocks that is confirmed on the Bitcoin network takes about nine minutes, on average. However, blocks in the Litecoin network requires two and a quarter minutes.

Litecoin is actually the definition of a “testnet” to test Bitcoin’s Blockchain development. For instance, Litecoin was the first to adopt its Lightning Network, a second-layer technology in Bitcoin that permits the creation of micropayment channels to facilitate transactions.

How do I purchase Litecoin?

If you’ve done your research on Litecoin and are convinced that it’s an investment worth making and you’re ready to know the best way to get some yourself. There are many ways to purchase cryptocurrency, however there are many frauds as well. To buy Litecoin secure Follow the steps in the following paragraphs.

1. Select a crypto exchange.

A cryptocurrency exchange, like Coinbase or Gemini is the most popular method of purchasing cryptocurrency. The Cash app, PayPal and Venmo are only a few of the payment and investment apps that provide cryptocurrency.

Examine the security measures of the platform and check if any problems like hackers or stolen money were experienced previously. The most important thing to consider when using an online crypto-based platform is the protection of your personal information and funds.

costs: There are fees for both buying as well as selling cryptocurrency. Be sure that the exchange you choose offers rates that are similar to other major exchanges.

User-friendly: Buying cryptocurrency shouldn’t be a hassle and you should pick one you’re familiar with.

Another factor is the choice of currency worth taking into consideration. For instance, if you’re only curious about Litecoin because it’s available on a variety of exchanges. But, if you’re thinking of purchasing smaller currencies in the near future the choice of cryptocurrency is crucial when choosing a company.

2. Set up an account.

You’re now ready to create an account once you’ve determined the best place to purchase Litecoin. The process differs for each exchange However, the button usually will say “Get going” (or “Register.”

3. Select what amount Litecoin you want to buy.

Like other cryptocurrency the best rule of thumb is to invest as much as you are able to risk.

Values for cryptocurrency fluctuate even though they may increase, they could be sunk to the bottom. The best general rule of thumb is to limit your use of cryptocurrencies at a minimum of 10% to 5 percent of your overall investment portfolio. Don’t make use of crypto as a retirement plan also don’t make use of it for an emergency fund.

Think about how often you’ll buy Litecoin. Many investors make one massive purchase or make periodic purchase without anticipating ahead. Averaging the cost of a dollar is generally an ideal method to invest in bitcoin.

It is possible to make recurring investments by dollar-cost average. For instance, you could buy $250 worth of Litecoin each two weeks or every month. It is a great option for investments that are volatile because you don’t have to put all your money into all at once, regardless of the price drops.

4. Buy your item

The purchase procedure and payment options are able to be decided by the payment method you select. The option of an ACH transfer through the bank account or debit card or credit card can be one of the viable payment choices. Since using a debit or credit card may result in charges and fees, bank transfer is usually the most cost-effective option.

One drawback with transfer money to your bank account that is their insanity. In general, transfers take a few days to complete and the money will be deposited on your bank account.

Choose Litecoin on the “Buy” menu when the funds are in place. Enter the amount you’d like to purchase , and look at the preview of your transaction to see the cost and amount of Litecoin you’ll receive. Check the transaction is confirmed if you’re satisfied with the transaction.

Where can you purchase Litecoin?

As Litecoin increases in popularity as it gains popularity, the number of cryptocurrency exchanges who offer it is growing.

Purchase Litecoin through eToro has pros It is easy to use and comes with numerous payment options Pros accessing the actual coins is more difficult. eToro is an extremely well-known website for trading in cryptocurrency that lets you trade the cryptocurrency Litecoin. Additionally, you can trade other cryptocurrency in exchange for dollars in fiat (i.e.. Dollars, Euros, etc.). In other words, eToro caters to traders instead of customers who truly desire to control their money.

Coinmama is a website on which you can purchase Litecoin. Benefits: Simple purchasing process and dependable company Cons: The costs are quite high. You can buy Litecoins instantly using your credit card, debit card or SEPA transfer through Coinmama. Users can use the service from almost every country in the world (excluding some states in the US). The company is in operation for quite a while (since 2013,) and is widely known.

The value of Litecoin

One of the major reasons for the development of cryptocurrencies is the speedy and low-cost flow of money. In this sense the greater the value for the user the more quickly a crypto network will be able to execute transactions (and the lower the cost associated to the transactions).

The crypto network is able to earn gold stars when it comes to the case of Litecoin.

Litecoin is a great option for people who wish to send massive amounts of cash, even if it’s not the fastest digital currency of the massive-cap cryptocurrency networks. The digital currency has proven to complete transactions 4 times quicker as Bitcoin (CRYPTO:BTC). The time for creating a block for the Litecoin network is expected to be approximately 2.5 minutes, as opposed to 10 minutes for Bitcoin. Bitcoin network. This is a major difference. This could be the most significant technological distinction between the initial Bitcoin sources and Litecoin duplicate, aside from the encryption methods used.

In light of the delays encountered by some of the major cryptocurrency networks in peak times smaller networks that are more flexible, such as Litecoin are expected to attract more interest. In addition the Litecoin network’s low-cost fees are attractive to those who make use of it for transfers. For those who want to get the most value from the network Litecoin will be the more efficient and affordable option. It’s a must-consider option when who are considering buying Litecoin.

How do I Mine Litecoin?

Mining Litecoin is the process of providing the network with processing power, which is commonly referred to as the hash power. Anyone who has access to computing power can be a part of mining because Litecoin is an open and permissionless system, similar to Bitcoin. It was possible to mine Litecoin with personal computer hardware like the traditional GPU or CPU in the beginning of cryptocurrency (both of which are computers processing devices). Mining has become more challenging since more and more professional actors provide more hash make up the cryptocurrency that is unable to more be mined efficiently using CPUs or GPU graphics equipment.

Applications-specific integrated (ASIC) mining equipments are required to mine Litcoin at a rate that is competitive. The ASIC mining devices were designed specifically to mine the Litecoin. Although Bitcoinualso uses ASIC miner, these chips utilize another algorithm. The mining algorithm SHA-256 is used the same algorithm as Bitcoin. Litecoin is, on the other process hash functions with an entirely different algorithm, known by the name “Scrypt.” Although ASIC miners mine Litecoin can’t mine Bitcoin but they might be able to mining other currencies, most especially Dogecoin which utilizes the same algorithm for scripts as Bitcoin.

Mining Litecoin is currently dominated by mining pool operators, similar as Bitcoin mining is now dominated by mining pools, similar to Bitcoin. If a company has small number of Scrypt-based ASIC processors, it’s advised to set them up within mining farms. Smaller miners can join with a significant amount of hashing power in this manner which increases the chances that his mining equipment will provide a steady flow of block rewards. When the mining farm locates an entirely new block, the less experienced miner gets a portion of the reward based on the amount of hashing power provided. As shown in this graph three mining pools currently have control over more than half the hashing rates. Its market cap is the cryptocurrency Litecoin

Being a trusted cryptocurrency, Litecoin tends retain its value well and is less volatile, especially when compared with meme currencies. Although it is the gold to bitcoin’s silver however, it has not performed as well in terms of price over the past 10 decades of trading. This could be because of the rise of other cryptocurrency alternatives with new features, such as smart contracts GameFi, Defii, GameFi governance, and more.

On the 10th of May in 2021, the price reached the all-time record price of $410. In the past year, price for Litcoin is up about 20%..

Market participants are eager to find out what the value of the cryptocurrency will be in 2025. Litecoin analyzes the wider cryptocurrency market on the basis of the previous results. Furthermore, Litecoin tends to rise in line with the price of bitcoin as well as the overall cryptocurrency market.

Prediction of Litecoin

The trend upwards in the LTC/USD price which began at the end of the year 2020 but continued through the year to come will continue until 2022. An increase in the cost of Litecoin could be seen anywhere in the end of 2022 and the beginning of next year which will bring it to its highest level of $330. This will be followed by extreme price fluctuations before 2022’s end. It is expected to fall in the $191-$219 price range by the beginning of 2022.

Based on Litecoin projections based on the way it has performed in the past, and how Litecoin has performed previously, they expect to hit an average of $295 in a single year, which is an +185.92 percent increase over the price currently. The Litecoin price projection for 2023 indicates that LTC will be able to reach a maximum price of $350, and the lowest cost of $254.

With the rapid adoption of Litecoin and other cryptocurrencies by an increasing number of people. A pool investment could prove to be a smart option in the future. Based on past information and forecasts, this Litecoin price forecast predicts at least $322 for each coin.

If we try to determine the value of Litecoin worth in 2025. CryptoNewsZ predicts that the price could fluctuate between $390 to $500 by the time it is. In order for the currency to be able to keep its value on the exchange, it could require significant adjustments to markets, scenarios in the industry and economic overruns as well as policies being restructured or another reason that is political. However, LTC recognizes it for being stable and reliable. Although global economic conditions could affect the price of Litecoin, but the one-year forecast for Litecoin appears to be positive so far.

Certain analysts think that a market correction could take place at this point, which will result in a decrease in the price of LTC to the $425 mark by 2025. LTC’s market capitalization and price are affected by regional changes. In Singapore for instance the new retail center has set up an ATM that will accept Bitcoin and ATM for Litecoin.

In the end something that is certain about LTC will be that the stars are shining for this investment in its quest to reach its goals for the future. LTC is on a mission to make an incredible mark on the ecosystem, changing the entire global web of transactions. A few predictions regarding the cost of LTC in 2023 are that LTC will begin to gain momentum the coming year, and in 2025, the price of Litecoin will be at the record-breaking amount of $500. Litecoin is currently striving to reach an all-time high, which is proving its status as a stable.

| DMER Home Page | Click Here |