Originally posted on April 29, 2022 @ 12:47 pm

How to Activate Your Wisely Pay Cards Online? This article will provide information about the process and help you activate your card. Learn why pre-paid cards are a good option and why you need to protect your personal information. To get started, click on the Activate Your Wisely Pay card online link below. You will then need to input the card’s three-digit CVV number and your personal information, including your legal first and last name, birthdate, and address. You will also need to enter a four-digit pin code. Once you have inputted all of the information requested, you can then proceed to activate your card.

Activating your Wisely Pay Card online

If you have a Wisely account, you can activate your card online. You’ll have to enter your 3-digit CVV number and personal information such as your legal first and last name, birthdate, address, phone number, and 4-digit PIN code to complete the activation process. Once you’ve entered this information, you’re ready to start using your card. Wisely cards work with ATMs and can be used to pay for goods and services.

Activating your Wisely Pay card is free and quick. All you need is your account number and password. You can also set limits on your card to limit the amount of money you spend every month. Wisely offers an easy-to-understand breakdown of your card’s current status. Activating your Wisely card is ideal for short-term use, as you can use it to pay bills or access cash quickly and easily. The card is an excellent investment for low-income families, as it helps you manage your money more effectively.

Once you’ve activated your Wisely Pay card, you can start making purchases and track your spending. You can use your card at stores that accept Visa debit cards, Walmart gift cards, and Target. You can also use it at any grocery store in the US. By using the ADP activated card, you can even make purchases on the go. If you’re not sure if your Wisely Pay card is active or not, you can check your balance online.

How to activate your card online

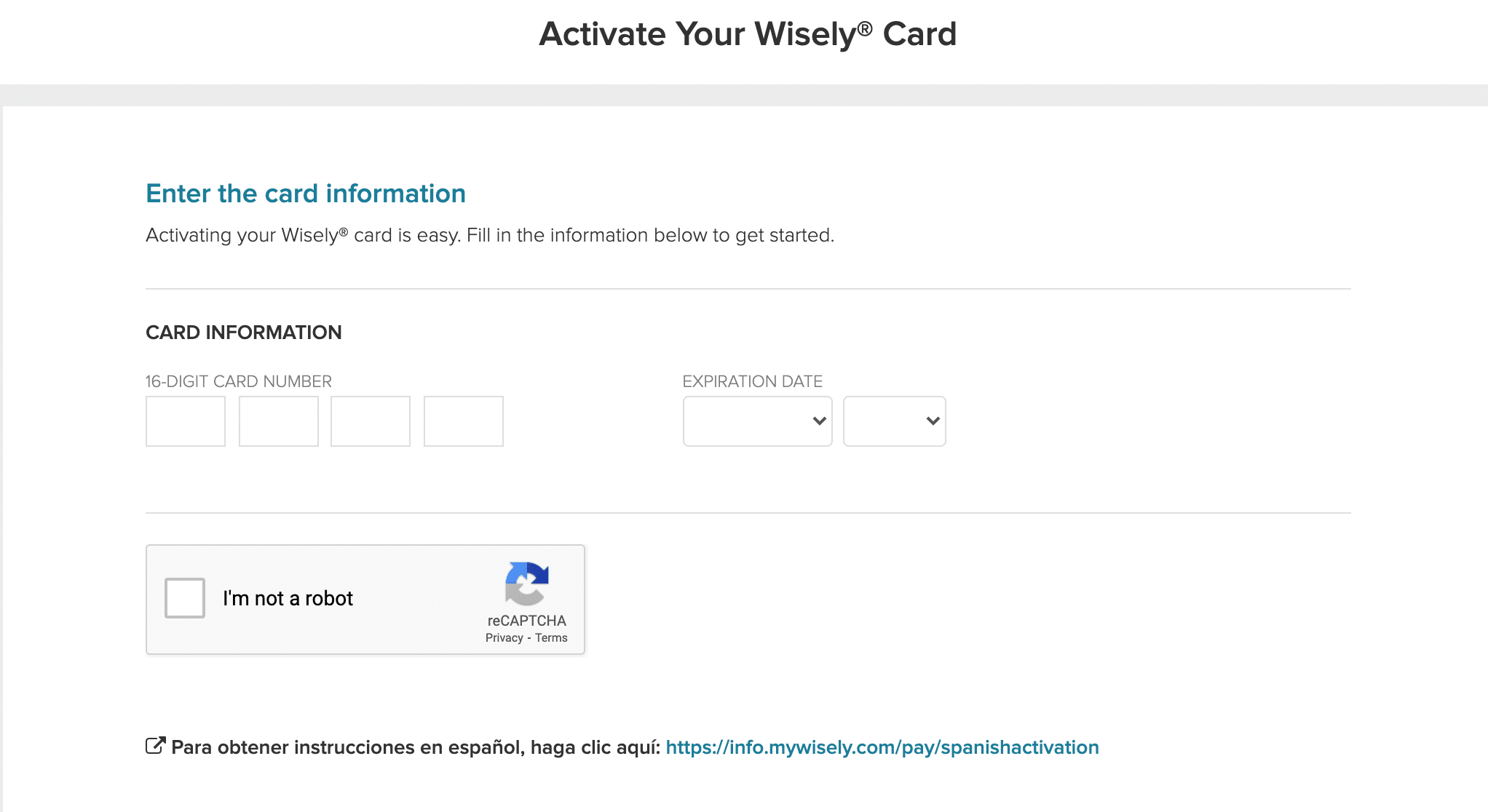

Step 1: Open the above provided website www.activatewisely.com in your web browser, then enter your card number and CVV number. The CVV number is the 3-digit number shown on the right of your signature.

Step 2: Click on the “Submit” button to continue, then you need to provide your personal information to fill out the registration form.

Step 3: Activate your card and create your online account of Accountnow.com.

To activate your card by phone, just call 866-313-6901 and follow the instructions. For more questions, visit www.activatewisely.com!

How it works

If you want to activate your Wisely Pay card, you may have to fill out the following form. You will need to input your 3-digit CVV number, your legal first and last name, birthdate, address, phone number, and a four-digit pin code. Once you’ve completed the form, your card will be ready to use. The card will arrive in seven to ten days.

Once you receive your Wisely Pay card, you can activate it at participating retailers. You can use it anywhere MasterCard is accepted, and it will let you withdraw cash from ATM machines. The application is free and offers no monthly fee. You can even pay your bill with it. The process of activating your card online is quick and easy. After completing the form, you can use the card wherever you can use cash.

Once your card is ready to be used, you must first add money to your account. If you don’t have enough money on your Wisely Pay card, you can add it online or in person. You can add money online by visiting a participating retailer’s website. You’ll be prompted to enter your six-digit PIN. To get started, follow these simple steps:

After activating your card, you can access your account balance on your card and manage your money in MyWisely. You can also add family members to your card to use it for purchases. MyWisely App allows you to load funds from your government benefits such as tax refunds and IRAs. Your card will work at participating retailers that accept the card. You can even get a customized Wisely Pay card.

Prepaid cards are good for short-term use

Wisely Pay prepaid cards are designed for short-term spending. They allow you to spend only what is on your card and cannot overdraw. These cards do have a limit on the number of fee-free ATM transactions, but otherwise they are the same as traditional debit cards. They also do not build credit. Users will be charged standard text messaging rates and third-party fees, but the prepaid cards are zero liability. Nearly all cardholders receive their paychecks before 9 am so they can use the cards at work to make purchases.

While prepaid cards do not help you build credit, they can be a good first step to a credit card. They function like debit cards in that you can load funds on the card using direct deposit transfers or other methods. Then you can spend the money on your card without affecting your credit score. In contrast, a credit card allows you to borrow against a predetermined limit. After you have paid off the card, you make monthly payments to the bank or credit card company, and your payment history is reported to the three major credit bureaus.

Wisely Pay prepaid cards are a great option if you are only planning to use them for short-term use. Because they do not build credit, you can load any amount of money on the card and only pay for the items you need. You can also give prepaid cards to housekeepers and nannies. Prepaid cards also offer protection from fraud and loss. However, be sure to report any lost or stolen cards to your bank or credit card company immediately.

Fraud protection

When you activate your Wisely Pay card online, you can use it anywhere Visa debit cards are accepted. The Wisely cash Visa card is also protected by fraud protection. It is available in more than 70 countries, which makes it easy to make purchases. And the best part is, the card is FDIC-insured. To avoid unauthorized purchases, you can lock your card using the myWisely app.

Benefits of using a Wisely Pay Card

Using a Wisely Pay card is a great way to increase your employee’s financial wellness. The app features many capabilities, including adding funds from other accounts, checking the balance, and shopping online. You can also use your card in physical stores and get 12% cash back on purchases. You can also have a secondary card for family members. And, there’s no monthly fee or other hidden fees.

With a Wisely Pay Card, you can use the Visa network wherever you go, making it a convenient and secure way to pay for everything. It’s accepted worldwide, and its acceptance in mobile wallets, such as Apple Pay and Google Pay, is expanding. You’ll also enjoy free surcharges at over 80,000 ATMs, cash back in major retail outlets, and financial wellness tools on the myWisely app. It’s safe to use, thanks to its FDIC insurance, and its zero liability policy.

Check Also: